Connect June 2014

Financial news for tomorrow’s lifestyle

EDITORIAL

It’s hard to believe we are approaching the end of another financial year. Where has this year gone? It’s that time of year when most people are starting to prepare for their annual duel with the tax man.

There are always those who leave their tax preparations to the 30th June. This is not a good approach to tax planning, you need to give yourself enough time to seriously look at ways to get back some of the money you have paid out in tax during the year, or at least look at some strategies that will prevent you having to pay further large sums from your earnings in the future.

With the excessive tax and levies we pay each year, it is estimated that many of us are paying 68% of our hard earned money in tax and levies, which means that approximately the first half of the year we are working to pay off our taxes. When you contrast that with how much tax you are paying and with how little some other people are paying, and 34% of the population on welfare (8 million people we are led to believe) it is sure to get your hackles up.

There are a number of suggestions in this month’s edition to help you in your tax planning.

John Osborne

TAX TIPS FOR EMPLOYEES

Those who are straight PAYE tax payers who don’t have other sources of income such as rental property or dividend income, where they can claim interest on borrowed funds for investment, have little room to move as far as tax savings.

Those who are straight PAYE tax payers who don’t have other sources of income such as rental property or dividend income, where they can claim interest on borrowed funds for investment, have little room to move as far as tax savings.

Salary sacrificing into super

Most employers will allow their employees to salary sacrifice into superannuation which means boosting the pre-tax (employer) contributions into super and taking less of your income on an after tax basis. The benefit of this is that tax on employer contributions to a super fund is 15%. This means that 85% of your money is being invested, avoiding full marginal tax rates if invested outside of super, investing out of after tax income.

Spouse contributions

A tax rebate is available for people contributing to their spouse’s super fund. The maximum rebate is $540 available where the spouse’s income is less than $13,000 a year. The 18% rebate is payable on contributions up to $3,000. While the rebate is available only on the first $3,000, there is no limit on the amount that can be contributed up to the current contribution caps. Your spouse must be under 70 years. Conditions apply between ages 65 and 69.

Income tax offsets for families

Tax offsets help to reduce the amount of tax you have to pay. Basically each dollar of tax offset reduces your tax payable by one dollar regardless of your income. Tax offsets can reduce your tax to zero but they will not give you a refund. They can reduce any medicare levy you have to pay and most offsets are subject to income thresholds.

Some of the tax offsets are:

- taxpayers with dependants

- medical expenses

- government benefits

- low income

- seniors and pensioners

- private health insurance

- spouse superannuation

Negative gearing into shares or property

Borrowing to invest in shares or property is a way for employees to reduce their tax. All interest and other costs associated with borrowing to invest are tax deductible. While gearing into shares is very attractive when the market is going up, the other side is when the market goes down, there is risk. The thing is to be sensible with your gear and not gear too high. Gearing requires that you have the income to sustain the investment along the way to pay interest if your property is without tenants or meet margin calls if the market falls. If you gear at sensible limits, margin calls should not be experienced. Always seek professional advise.

Salary packaging

Salary packaging is an Australian Tax Office (ATO) approved way of reducing your income. It enables you to buy a range of every day items out of your pre-tax salary, rather than your after-tax salary. There are a number of items the ATO allows most employees to package, although the choice is dependent on the type of organisation you work for. Your employer can also have a say in what items. The most popular items are superannuation, laptops and cars. If you work for a public hospital or not for profit organisation, you can package meals, entertainment, living expenses, loan and mortgage repayments, rent, credit card payments, bills and more. Seek advise from a professional accountant as to what you are eligible for.

Travel allowances

In a number of circumstances, claims for reasonable travel allowances for domestic and overseas travel expenses include:

- accommodation

- meals

- deductible expenses which are incidental to travel.

The rules for domestic travel apply for stays in commercial establishments only, for example:

- hotels

- motels

- services apartments

Travel between home and work

In certain circumstances claims for travel between home and work are allowed, including if you are required to travel to different locations, if you have to carry bulky equipment for your job, if your job starts before you leave home (eg a doctor who gives instructions by phone before leaving home). The Tax Office closely monitors travel claims. Don’t assume that because you are paid under an industrial amount you are entitled to a travel claim.

Self education

The rules covering self education are clearly defined by the Tax Office. To be eligible, self education expenses must be incurred on a course specifically related to your current occupation which will help you perform better in your job. In some circumstances, you have to reduce the amount of your claim for the first $250. Provided the course is approved, expenses including tuition fees, text books and journals, depreciation of professional libraries, fares and travel costs, accommodation and interest payable on a loan to finance any of these expenses, can be claimed.

Pre-pay expenses

Pre-paying deductible expenses is one of the simplest year-end tax strategies, bringing forward deductible expenses. Expenses that can be brought forward include interest, commissions, lease payments, travel costs, insurance and advertising. Some conditions must be met to be sure of securing a current year deduction.

Super for the self employed

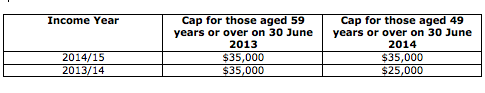

If you’re a sole trader or partner in a partnership, you don’t have to make super contributions to a super fund for yourself. However, you may want to consider super as a way of saving for your retirement as well as a way of reducing your tax. Concessional contribution caps apply for the 2013/14 year of $25,000. For people aged 59 years or over on 30 June 2014, the concessional contribution cap will be $35,000.

Motor vehicle expenses

If you use your car for work or related travel, you can claim a deduction based on a number of methods. You can pick the one that gives you the highest deduction (not usually for travel to and from work). Check with an accountant for the best method for your circumstances.

TAX TIPS FOR SMALL BUSINESS

Industry benchmarks

The Tax Office looks for tax returns where the margins or expenditure varies significantly from their averages. The benchmark profit and expenditure figures are widely available.

Offset capital gains and losses

Both capital gains and losses are guaranteed from ordinary income. If you have made any capital gain during the year, have a look to see if you have any unrealised capital losses which can be realised and written off before 30 June.

Ensuring deductions from bad debts

To get a deduction for bad debts, the debt has to be physically written off by 30 June. To write off a bad debt you must have given up all hope of recovering it.

Write off old plant and equipment before 30 June

If you have assets in your books that have no real value, a write off deduction can be claimed but action needs to be taken prior to 30 June.

Superannuation

Ensure your employee super capital guarantee contributions are paid. If you don’t meet your super guarantee obligations, you’ll be liable for heavy penalties. This is an easy area to slip up on, particularly for employers who employ a lot of casual and seasonal workers.

Be prepared for an audit

With the Tax Office stepping up its audit program in the small business area, these changes are not so much a question of “will I be audited?” but rather “when?”. Tax payers must be able to prove their claims and provide an adequate paper-trail.

GIFTING WEALTH

While there are no limits as to how much you are able to gift to your children, there are a number of issues to consider. If you gift shares to your children, there will be CGT consequences, as this will be treated as a sale and assessable gains will be taxed at your marginal tax rate.However if your shares were to be gifted to your children through your will on your death, there wouldn’t be any capital gains tax payable by you, and instead your children would be the ones to pay the tax when they decide to sell the shares.

When gifting to your children prior to your retirement, you need to consider your own retirement security. It is a fact that we are living longer. A person retiring back in the 60’s may have lived only 7-8 years in retirement, but today you can be in retirement up to 30 years. It is very important that before you gift money or assets you consider whether you have enough assets both inside and outside super to last throughout your retirement years.

If you would like to receive some Age Pension in retirement, you need to consider the impact that gifting assets could have on your Age Pension eligibility and entitlement. Under Centrelink’s ‘gifting’ rules, you may gift up to $10,000 per financial year but not more than $30,000 over any five year rolling period. Any gift or combination of gifts in excess of these limits will be assessed under both the assets test and income test for a period of five years from the date of the gift.

In the later stages of your retirement you may also need to consider the high costs of aged care. You may need to meet the ongoing costs of home care, or possibly fund a large bond on entry into a comfortable serviced accommodation in an aged care facility. Appropriate pre-retirement planning is extremely important and can help you to determine if and when gifting assets is appropriate for you.

Estate Planning

Estate Planning is a minefield. I encourage you to seek advice from an experienced solicitor who specialises in this area. Estate Planning is not just obtaining a simple will, but should take into consideration other factors such as the money skills of your children, plus the impact if they were to divorce or go into bankruptcy. An effective estate plan includes tax effective wills to protect your estate and the interests of your beneficiaries in the event of your death. You want to ensure all your assets are transferred according to your wishes in the most effective and efficient manner, so it is important to get both your financial planner and your solicitor involved in your estate planning.

Lorena Millet

If you would like to know more about how gifting during your life and after your death could affect your retirement and estate planning, please contact us on 02 9970 3111.

SELLING ASSETS

As you head into retirement the trick is to consider how to use your assets to build up your superannuation. If you have built up a large asset in your own home, you may consider a sea or tree change. For many of us living in Sydney, our properties are worth $1,000,000 plus. The house is possibly two stories with four or five bedrooms and large living areas with a sizeable garden to maintain. As you approach retirement you may be thinking about travelling and enjoying your retirement years. Making a sea or tree change can release substantial funds to inject into your super with no capital gains tax considerations, provided you have been the owner occupier and have not had periods where you have rented the property.

If you hold business property there is a range of concessions for the sale of your business. Capital Gains Tax (CGT) concessions may include a 50% active asset exemption for the sale of non-depreciating assets in the business as well as the $500,000 retirement exemption. CGT will be payable on the sale of your investment properties you hold. If you have held the investment property, the 50% discount on the capital gain will apply. If you sell the property after you retire, the gain may be your only income and with the $18,2000 tax free threshold plus the loss of income tax offset, there may be nil or little tax to pay.

Seeking advise from an accountant before you retire is wise as work tests may apply before you can make any super contributions.

DID YOU KNOW

Up to 30 June this year you can make a non-concessional contribution of up to $150,000 into your super. Clients under age 65 may effectively bring forward two years’ worth of entitlements of non-concessional contributions, allowing them to contribute a greater amount (ie $450,000 in 2013/14) without exceeding their non-concessional cap. If you wait until July 2014 this limit increases to $180,000 per year or three years at once of $540,000.

Buying a property in a regional area or up north could release $500,000 plus to inject into your super.

END OF FINANCIAL YEAR LEASING

It’s that time of year to consider what you may require for your business.

Do you need to make a new business or personal vehicle purchase? How about an investment in equipment for next financial year?

You may need to consider purchasing one the following:

- Vehicles (passenger) – includes passenger vehicles and small commercial vehicles

- Vehicles (other) – buses, trucks, utilities and other wheels

- Yellow goods – forklifts, backhoes, bulldozers, excavators, graders, loaders and rollers

- Equipment – computers, printing press, photocpiers, edge binders

- Other goods – medical and dental equipment, manufacturing equipment

To speak to a Finance Manager call on 02 9970 3111.